Currently, the banking landscape is forcing banks to rethink their business processes to adapt to the new environment. But, without technological intervention, banks will find themselves battling rising costs and inefficiencies in an increasingly fragmented and competitive marketplace.

As a result, N2WDMS is a state-of-the-art user friendly solution, which helps the organization better manage the creation, revision, approval, dissemination, and collaboration of electronic documents.

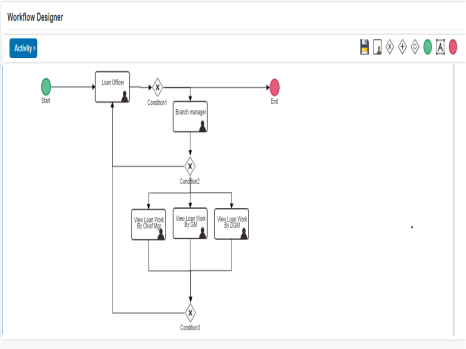

Dynamic work allocation

Loan application can automatically be assigned to a specific team or person depending on the loan amount and risk profile or workload

Roles and Rights-based access

Documents or KYC information can only be given access in a restricted manner depending upon employee designation, role in an organization. It helps in preventing revealing sensitive information to an unnourished person.

Makes document retrieval easy

Document can be easily searched or retrieved using two methods 1) Metadata 2) Full-text search.

1. Metadata

Metadata or Tags are representational data about a document or content. Which can be used to find exact documents or information

2. Full-text search

Full-text search is a tool that allows you to search through the body text of the documents. This is different than merely searching the file names. Hence the name full-text search, since it goes through the actual document contents.

Workflow analytics

Workflow analytic will help locate process bottlenecks time taken at each stage of approval. In addition, a live dashboard can bring important business insights which help in the decision-making.

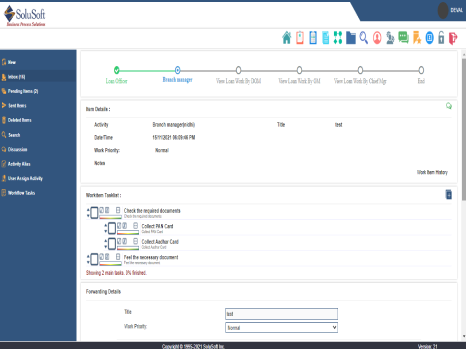

Tasks & Check List

At each stage of the process, a mandatory checklist and tasks can be assigned so that the knowledge worker follows the standard approval process, i.e., KYC documents, credit score, etc.

GUI based form design

Forms related to different banking services can be exactly replicated in the workflow such that it is easier for the knowledge worker and customers to familiarize themselves with the system

-

Easy regulatory compliance : With N2WDMS software, documents can be captured, stored, and organized electronically, allowing loan origination teams to keep an organization’s crucial information encrypted and stored in a centralized repository which helps the bank to be fully compliant with government rules

-

Analytics and fraud detection : With data-driven engines, better and accurate data is captured, which helps in data analysis to prevent fraud in real-time.

-

Disaster recovery : Physical records can be lost or destroyed in an accident or due to theft, eliminating your only known copy of a document.

-

Improve efficiency and productivity : Implementation of Banking Workflow Solution helps in tracking applications and brings accountability. Now, the manager can look into more credit applications and complex scenarios than before

-

Better risk management : Implementing rule-based application processing brings better regulatory compliance and quality decision-making.

-

Paperless environment : With digitized application processing, reduce risks of misplacing documents and the cost of storing documents.